Visit to “www.Milestonecard.com/activate” to quickly and conveniently activate, apply and register your new Milestone credit card. Simply follow our step by step guide on the website. This tutorial will help you get started with your card so you can start using its perks right away. It’s quick, simple, and designed to get you up and running in no time!

You can activate your My Milestone Card in just 5 minutes – Register & Apply! Just follow the steps below.

Milestone Card Details 2025

| Name Of The Card | Milestone Mastercard |

|---|---|

| Issued by | The Bank of Missouri and Serviced by Concora Credit Inc. |

| Provider | Mastercard |

| It provides | 24/7 Your Account |

| Customer Services | 1-800-305-0330 |

| Official URL | https://www.milestonegoldcard.com/ |

Pre – Requirements for Activate My Milestone Mastercard

1st: Activation Requirements:

Before activating your Milestone Card, make sure you have the following items ready:

- Your 16-digit Milestone Card number.

- Your Social Security number (SSN).

- Keep your zip code and date of birth handy, as well as any other important personal information.

2nd: Requirements Apply:

The following are the essential conditions for applying for a New Milestone Card.

- Age Requirement at least 18 years old.

- U.S. residency requires a genuine U.S. address (no P.O. Boxes).

- A valid Social Security number (SSN) is necessary.

- Provide proof of a consistent income.

How Do I Activate My Milestone Card?

You can activate your My Milestone Card In just 5 minutes Just follow the steps below:

There are two ways to activate it

- 1st: If you have 16 digit card number

- 2st: If you do not have 16 digit card number

| If You Have 16 Digit Card Number |

Step 1: Go to the Official Website

- Go to the >> https://www.milestonegoldcard.com/ Milestone Credit Card official website.

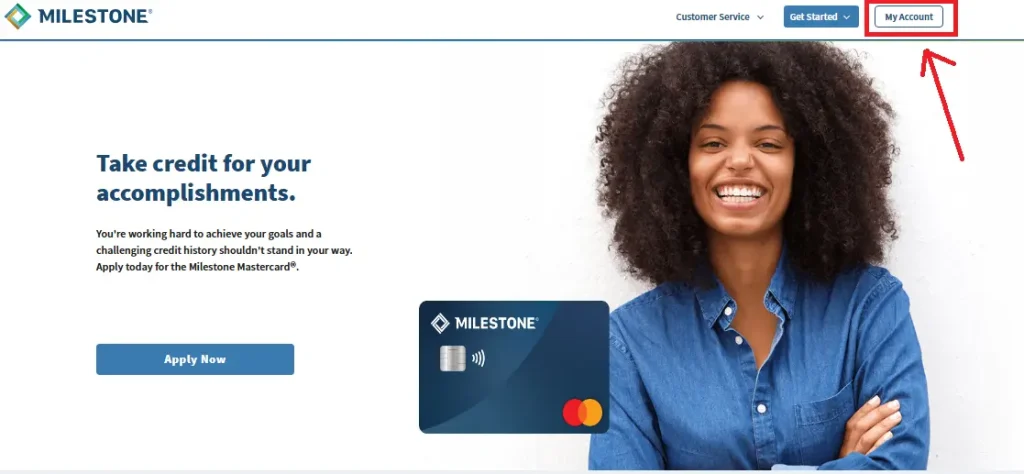

Step 2: Click on MyAccount:

- Then, click on the home page ‘MyAccount” option. [See Below Screenshort]

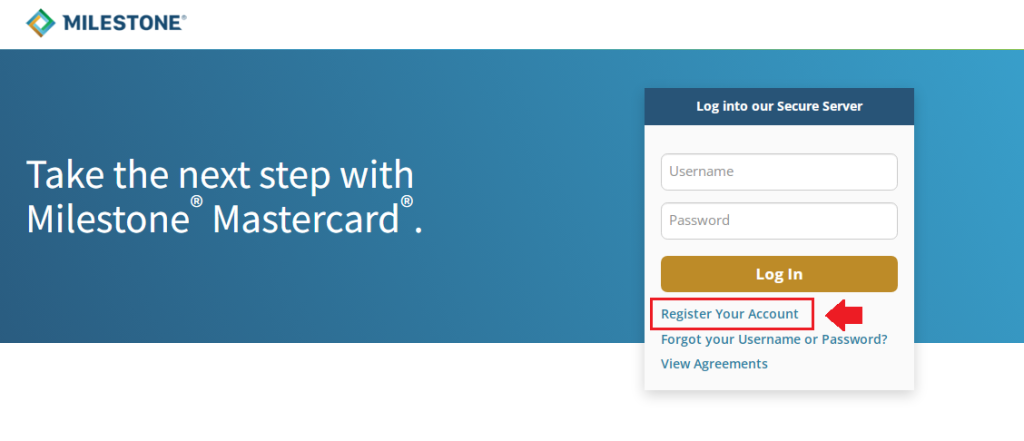

Step 3: Click on Registration:

- Clixck on the ‘Register Your Account’ option.

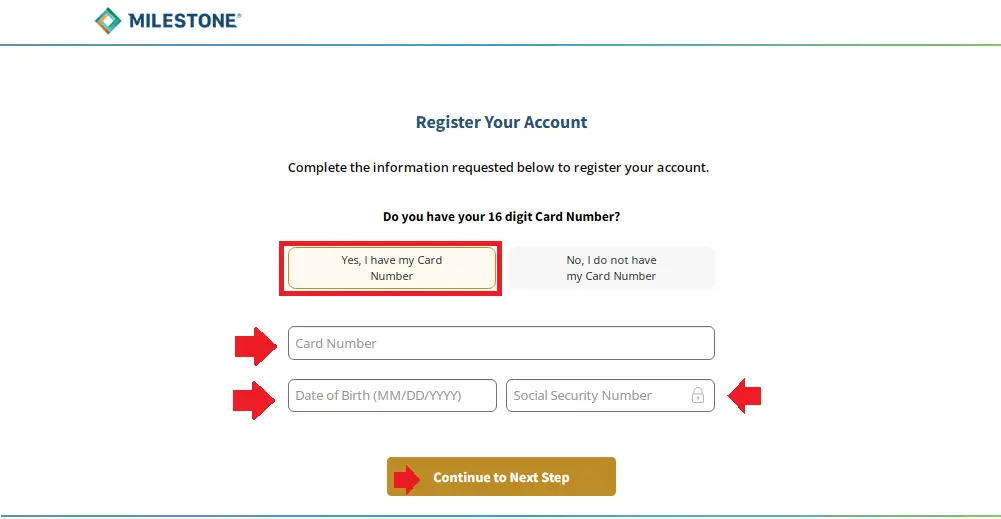

Step 3: Verify Card Ownership:

- Confirm by clicking ‘Yes, I have my Card Number.’

- Enter your 16-digit card number, date of birth, and social security number (SSN).

Step 4: Proceed with Registration

- After entering all information then, Click on ‘Continue to Next Step’ after filling in your information.

Step 5: Set Up Login Credentials

- Choose your preferred username and password.

Step 6: Identity Verification

- Complete any required steps to verify your identity.

Step 7: Finalize Registration

- Submit your details to complete the registration process.

| If you do not have 16 digit card number |

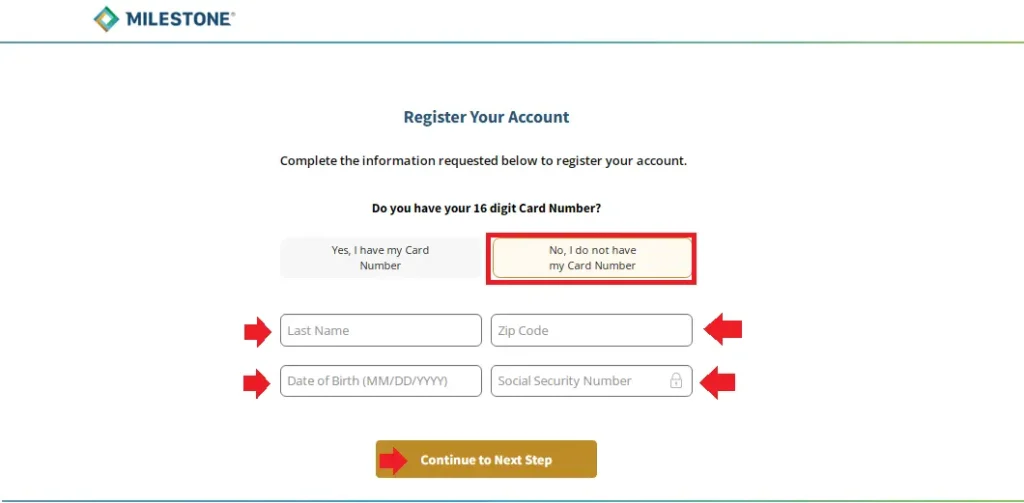

After clicking Register Your Account, follow these steps further, Because here Step 1, 2, 3 are same:

Step 3: Input Personal Information

- Choose ‘No, I do not have my Card Number’.

- Enter your Last Name, Zip Code, Date of Birth, and Social Security Number.

Step 4: Continue Registration

- After entering your personal information, then click on the ‘Continue to next step’.

Step 5: Set Up Your Account

- Create a username and password for future logins.

Step 6: Verify Identity

- Complete the necessary steps to verify your identity.

Step 7: Complete Registration

- Submit all of your information to complete the registration process.

Step 8: Access Your Account

- To access your account, log in with your newly established credentials.

Other Activation Sources – Phone & App

- Activation by Phone: Call the customer care number on your card, enter the requested information as prompted, and activate your card over the phone.

- Activation via Mobile App: Download the app from the App Store or Google Play, register or log in, and then follow the on screen instructions to easily activate your card from your mobile device.

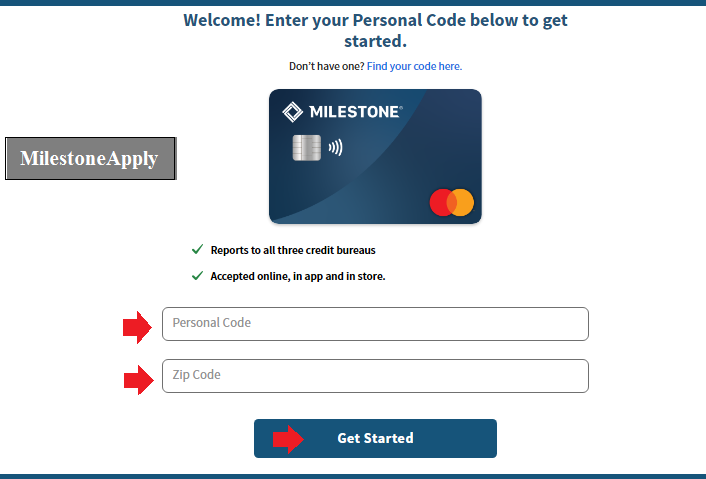

MilestoneApply Card At milestoneapply.com – Personal Code

To apply for a My Milestone Card using a personal code on milestoneapply.com, follow these simple steps:

- Go to milestoneapply.com.

- Now, enter your personal code & zip code you received, which is normally contained in your offer letter.

- Next, click on the Get Started blue button.

- Then, submit the your application.

- Wait for Milestone to confirm your application’s status.

- This could take a few minutes or a few days.

Don’t have one? Find your Milestoneapply.com Code

If you got a pre-approved postal offer from Milestone® Mastercard®, it included a MilestoneApply.com code, which is often printed as a 12-character Invitation Number on your letter.

How to Find Your MilestoneApply.com Code:

- Check Your Mail – Look for a Milestone credit card pre-approval letter.

- Find the Code – The invitation number (Milestone code) is usually near the top or bottom of the letter.

- Lost or Didn’t Get One? – You can’t apply through MilestoneApply.com without a code. Instead, visit the MilestoneCard.com to apply directly (not pre-approved).

What to Do After Card Activation?

- Sign your card: Sign on the back for security.

- Online Banking: Register to manage your account and monitor your spending online.

- Get the app: Download your card’s app for convenient account access.

- Set Alerts: Set up alerts for due payments and other relevant account activities.

- Go Paperless: Use electronic statements to protect your information and decrease clutter.

- Know Your Perks: Look into the perks your card provides, such as incentives or insurance.

Features of the Milestone Credit Card

- Credit Building Focus: This card is ideal for persons with low credit ratings looking to enhance their credit history.

- Accessible Application Process: The application is open to everybody and considers your entire financial status, not just your credit score.

- Flexible Credit Limits: If you use the card responsibly, your credit limit may increase.

- Milestone Based Rewards: When you meet your spending targets, you’ll earn bonus points.

- 24/7 Account Access: You can manage your account from anywhere via online access.

- Credit Reporting: Submit regular reports to the major credit bureaus to assist improve your credit score.

Additional Benefits of the Milestone Credit Card

Additional Benefits of the Milestone Credit Card

- Cashback Rewards

- Merchant Discounts

- Fraud Protection

- Mobile App

- No Security Deposit

- Flexible Payment Options

- Credit Education

- Worldwide Acceptance

- Balance Alerts

- Paperless Statements

Your Milestone Credit Card – Check Status & Pay Bill

Check the Status of Milestone Credit Card

To check the status of your Milestone credit card application or account, visit the Milestone Card website and log in. If you have not already set up online access, you can do so by registering on their website with your credit card information. Once logged in, you may see your application’s status, balance, and recent transactions.

Pay Your Milestone Credit Card Bill

Your Milestone credit card bill can be paid online on the Milestone Card website. After entering into your account, go to the payment section to set up a one time payment or schedule monthly payments. You can also pay over the phone by phoning their customer service or by mailing a check or money order to the address listed on your account.

Milestone Credit Card 2024 Overview

| Feature | Highlight |

|---|---|

| Annual Fee | $35 to $99 |

| APR | 24.90% |

| Credit Reporting | Reports to all three major credit bureaus |

| Pre-Qualification | No impact on credit score |

| Target Users | Individuals with less-than-perfect credit |

| Customer Service | 24/7 availability |

| Mobile App | Comprehensive account management |

| Fraud Protection | Zero liability for unauthorized charges |

Milestone Credit Card $700

- Initial Limit $700 credit line

- Credit Building Reports to major credit bureaus

- Purchases & Cash Advances Available for both

- Credit Score Impact Can improve with responsible use

- Interest Rate Typically higher APR

- Fees May include annual fee

- Eligibility Designed for lower credit scores

- Application Often pre qualification available

- Credit Monitoring Access to credit score updates

- Limit Increases Possible with good payment history

Is there a mobile app available for the Milestone credit card?

No, There is no dedicated mobile app for the Milestone credit card. Cardholders should access the Milestone website to manage their accounts, make payments, and track transactions. For any new upgrades to a mobile app, visit the Milestone website or contact customer care.

Milestone Card Customer Service Number

Customer Service: 1-800-305-0330

Other Help Support For You:

- Fax: 503-268-4711

- Technical Support: 1-800-705-5144

- Correspondence address: Concora Credit PO Box 4477 Beaverton, OR 97076-4477

Important Tips For User This Use Credit Card In 2025

- Pay on Time: To avoid late fees and credit score loss, pay your account by the due date.

- Manage credit limits: To boost your credit score, keep your balances modest.

- Review Statements: Check for unauthorized charges on a regular basis and keep track of your costs.

- Set alerts for transactions and due dates to keep track of your account.

- Understand the Terms: Understand your card’s rates, fees, and benefits.

- Maximize Rewards: Use rewards that provide the best value, such as travel or cash back.

- Build Credit: Use your card responsibly to improve your credit score.

Milestone Credit Card Payment

- Online: To make a payment online, go into your Milestone Credit Card account and follow the on screen instructions.

- Phone: Call the customer care number (+1-800-305-0330) on your card and follow the audio instructions to finish the payment.

- By mail: Send a check or money order, together with your account information, to Concora Credit PO Box 84059, Columbus, GA 31908-4059, Milestone’s approved payment address.

Milestone Credit Card: User Reviews with Star Ratings

Review 1: Sarah, New York Rating: ★★★☆☆ (3/5)

- Sarah appreciates the Milestone card for the potential to establish credit, despite the hefty fees.

Review 2: Mike, California: Rating: ★★★☆☆ (3/5)

- Mike enjoys the Milestone card’s ability to report to credit bureaus, which aids in credit score growth, but he does not like the limited incentives.

Review 3: Jenna, Florida Rating: ★★★★☆ (4/5)

- Jenna like the card’s no security deposit feature and the mobile app, but she wishes it included a rewards program.

Review 4: Ted, Ohio: Rating: ★★☆☆☆ (2/5)

- Ted is disappointed with the growing yearly cost, but he recognizes the card’s significance in facilitating acceptance and credit development.

Review 5: Linda, Washington Rating: ★★★★☆ (4/5)

- Linda views the Milestone card as crucial to her financial rehabilitation, recognizing its credit-building potential despite the hefty fees.

FAQs

Q1. How can I activate the Milestone credit card?

Ans: Visit www.mymilestonecard.com and click the activation link, or call customer care. Have your card and personal information ready for verification.

Q2. What does the Milestone card represent?

Ans: The Milestone card assists consumers in building or rebuilding their credit by reporting to the three major credit agencies and improving credit ratings through responsible use.

Q3. What is Milestone’s $700 credit limit?

Ans: The Milestone card has a credit limit of $700, which is intended to help you manage your spending while developing credit. It cannot be increased.

Q4. How can I check my Milestone account?

Ans: Visit the Milestone card website to check your account balance, view transactions, and change preferences. There is no app, thus all management is done online.

Q5. Is there a Milestone credit card application?

Ans: There is no mobile application for the Milestone credit card. All account administration must be completed via the official website.