Do you want to access your Milestone Credit Card account but are unclear where to begin? You are in the right place.

This comprehensive tutorial will explain all you need to know about the Milestone Credit Card login process, account management, and more. Whether you’re a first time cardholder or an experienced user, this article will help you browse your account with ease.

What is Milestone Card?

The Milestone Card is an unsecured credit card offered by The Bank of Missouri and administered by Genesis FS Card Services. It is intended for those who want to establish or rebuild their credit history, and it reports to all three main credit bureaus.

The card does not require a security deposit and contains services such as online account management, but it does charge an annual fee and other typical credit card fees.

Key Requirements For a Milestone Card Login

- You must already have a registered account.

- To login you must have the official website https://milestone.myfinanceservice.com/.

- You must have a username and password to login to your account.

- Other things like internet and device are also necessary

How do I log into my Milestone credit card?

Step by Step Milestone Credit Card Login Guide, but please follow these simple steps to access your account:

Step 1: Go to Official Site:

- First of all, you should visit the official website of Milestone Card or click on this link https://milestone.myfinanceservice.com/.

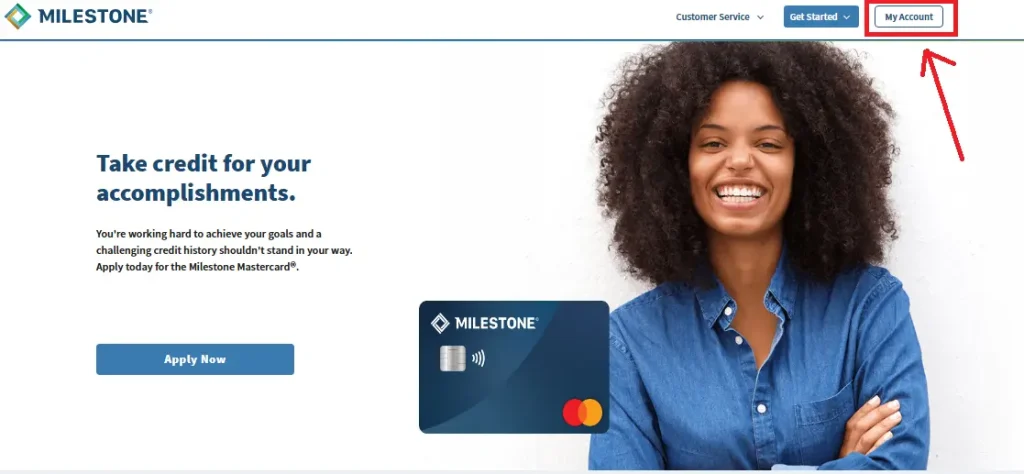

Step 2: Locate Login Section:

- Then, click on the “Account Access” area. [As given in the screenshot below]

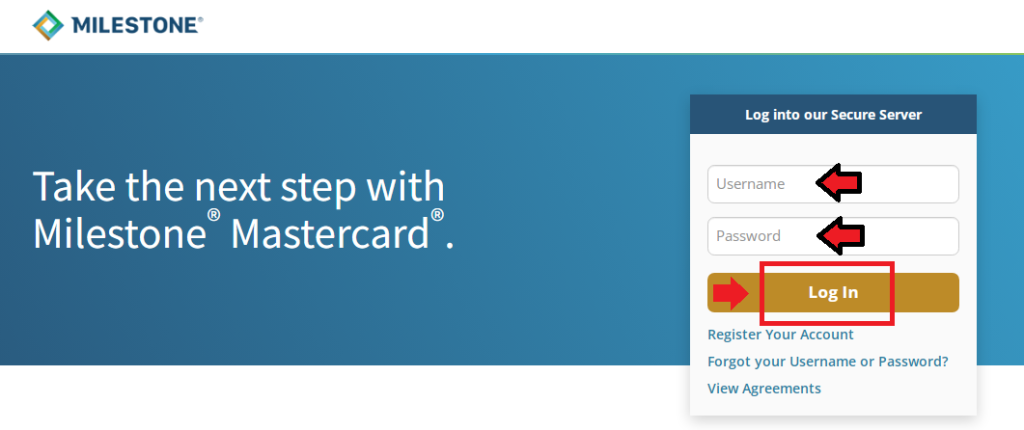

Step 3: Enter Your Credentials:

- Now, enter your login credentials such as username and password in the fields.

Step 4: Click ‘Login’:

- After entering all the information, click on the Log In button and you will be redirected to your Milestone Card dashboard.

If You Are Having Trouble Logging In, “Change Username or Password”

If you are experiencing problems login into your Milestone Credit Card account, changing your username or password will usually solve the problem. Here’s a little tutorial on how to achieve this:

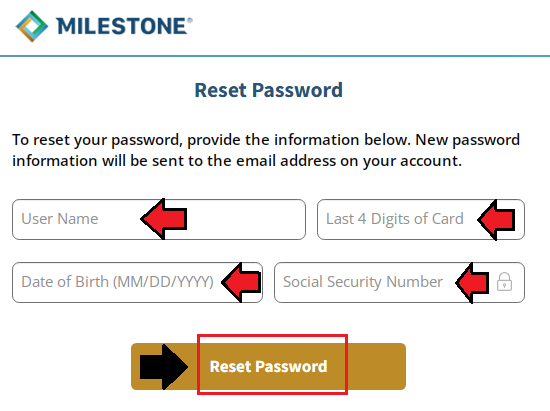

[A]: To Reset Your Password

- Go to www.mymilestonecard.com

- Click “Forgot Password?” link on the login page

- Now, enter your personal details such as

- Username,

- last 4 digit card,

- Date of birth &

- Social security number.

- After entering all the information then, click on “Reset password” button.

- Choose a password reset method (email or security questions).

- Follow the prompts to confirm your identity.

- Create a new password that matches the security criteria.

- Confirm your new password.

- Log in with your new password.

If you have changed your password, please try logging in once again.

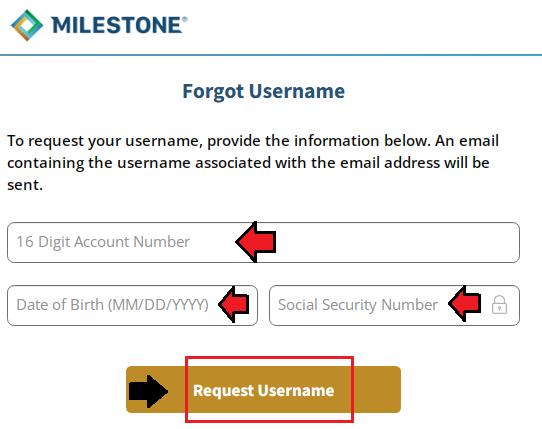

[B]: To Request Your Username

- Visit the official Milestone Credit Card website.

- Locate and click on the ‘Forgot Username’ link on the login page.

- Enter required information:

- 16-digit account number

- Date of birth

- Social Security number

- Click the ‘Request Username‘ button.

- Complete any additional identity verification steps.

- Retrieve your username:

- Displayed on screen or

- Sent to your registered email

Use the retrieved New username to log into your account.

Benefits and Features of The Milestone Credit Card

- Helps develop credit: Ideal for those with poor or no credit ratings.

- No deposit required: You do not have to pay money up advance to acquire the card.

- Reports to credit bureau: Having a strong payment history can help your credit score.

- Easy online account access: Check your balance and pay bills on our website.

- Use on your phone: The website works well with smartphones.

- Accepted in numerous areas: You can use it wherever MasterCard is accepted.

- May receive more credit later: If you use it properly, you may receive a larger spending limit.

- Check if you qualify easy: Check if you can receive the card without damaging your credit score.

- Choose your card’s design: Choose from various card looks.

- Protection from fraud: You are not responsible for charges that you did not make.

- Receive account alerts: Receive information regarding payments and odd conduct.

- Pay your bill in several ways: Online, by phone, or via mail.

Milestone Credit Card Imp. Facts

| Feature | Details |

|---|---|

| Credit Limit | $300-$750, determined by creditworthiness |

| Annual Fee | $35-$99, varies based on credit history |

| APR | 24.90%-26.90% applicable to both purchases and cash advances |

| Fraud Protection | Provided to ensure secure transactions |

| Credit Bureau Reporting | Genesis FS Card Services reports to major credit bureaus |

Who can Apply For The Milestone Card?

The following are the eligibility criteria for applying for the Milestone Credit Card, summarized in point form:

- Age Requirement At least 18 years old.

- Applicants must be US residents.

- You must have a valid Social Security number.

- Mailing Address please provide a physical mailing address (no PO Boxes).

- Credit History individuals with any form of credit history, including those who have been bankrupt, are eligible.

Activating Your Milestone Credit Card With Online, Phone & Mail

Activate Your Milestone Credit Card:

Online Activation:

- Visit www.mymilestonecard.com.

- Click on “Register” or “Activate Card”.

- Enter your sixteen digit card number.

- Provide personal information (date of birth, Social Security number, zip code).

- Create login credentials.

- Follow the steps to finish activation.

Phone Activation:

- Call the number on the sticker of your new card.

- Use the automated system or contact a salesperson.

- Please provide your card number and personal information.

- Follow the voice prompts to activate.

Email Activation:

- Certain cards may come pre activated.

- If not, find activation instructions in the welcome letter.

- Fill up any mandatory forms.

- Mail back to the address provided.

- Wait for the confirmation (typically 5-10 business days).

How to Pay Your Milestone Credit Card Bill?

- Online Payment: To make payments straight from your bank account, log in to your Milestone account via the internet.

- Phone Payment: To make a payment over the phone, call the customer service number on your card. You can use an automated system or chat with a professional.

- Mail Payment: Send checks or money orders to the address listed on your statement, and remember to include your account number.

- Mobile Payment: Access the website and make payments using your smartphone, just as you would on a desktop.

- Auto payments: Set up auto payments in your online account to deduct monthly payments from your bank account on a specific date.

Milestone Credit Card App

The Milestone Credit Card does not have a specific mobile app. However, cardholders can manage their accounts via a mobile-friendly website. To log in and access account features, simply visit milestone.myfinanceservice.com using your smartphone browser. It is recommended that you contact Milestone’s customer service for more thorough support or particular mobile features.

Milestone MasterCard Pros & Cons

| Pros | Cons |

|---|---|

| Helps build credit | High APR |

| No security deposit required | Annual fee |

| Reports to all 3 major credit bureaus | Limited credit limit initially |

| Pre-qualification with no impact on credit score | No rewards program |

| Widely accepted (Mastercard network) | Foreign transaction fees |

| Online account management | Potential for high fees |

| Potential for credit limit increases | Not suitable for those with good credit |

Milestone Credit Card Customer Service

| Service | Contact Details |

|---|---|

| Customer Service | 1-800-305-0330 |

| Fax | 503-268-4711 |

| Technical Support | 1-800-705-5144 |

| Correspondence Address | Concora Credit PO Box 4477 Beaverton, OR 97076-4477 |

Conclusion

The Milestone Credit Card provides a practical way for those with less than perfect credit to obtain credit and build their credit history. While it has certain expenses, the benefits, such as reporting to credit bureaus and no needed deposit, make it a desirable option for qualified applicants.

FAQs

Q1. How does one apply for a Milestone Credit Card?

Ans: You can apply online at the Milestone website by completing an application, which includes a mild credit check.

Q2. What is the interest rate on the Milestone Credit Card?

Ans: The APR for purchases and cash advances usually runs between 24.90% and 26.90%, depending on creditworthiness.

Q3. Can I use my Milestone Credit Card internationally?

Ans: Yes, the Milestone Credit Card is accepted worldwide wherever Mastercard is accepted, with a 1% foreign transaction fee applied.

Q4. What should I do if I lose my Milestone Credit Card?

Ans: To avoid unauthorized use, immediately report the lost card to Milestone customer service at 1-800-305-0330 and obtain a replacement.

Q5. How do I increase my credit limit on the Milestone Credit Card?

Ans: Credit limit upgrades are not issued automatically; however, they can be requested by contacting customer care after demonstrating responsible card use over time.